does san francisco have a payroll tax

All businesses with a. San Francisco taxes businesses based on gross receipts and payroll as well as business personal property like machinery equipment or fixtures.

Boma San Francisco Government Affairs Industry News For Commercial Real Estate Professionals San Francisco Commercial Rent Tax Proposed We Need Your Feedback

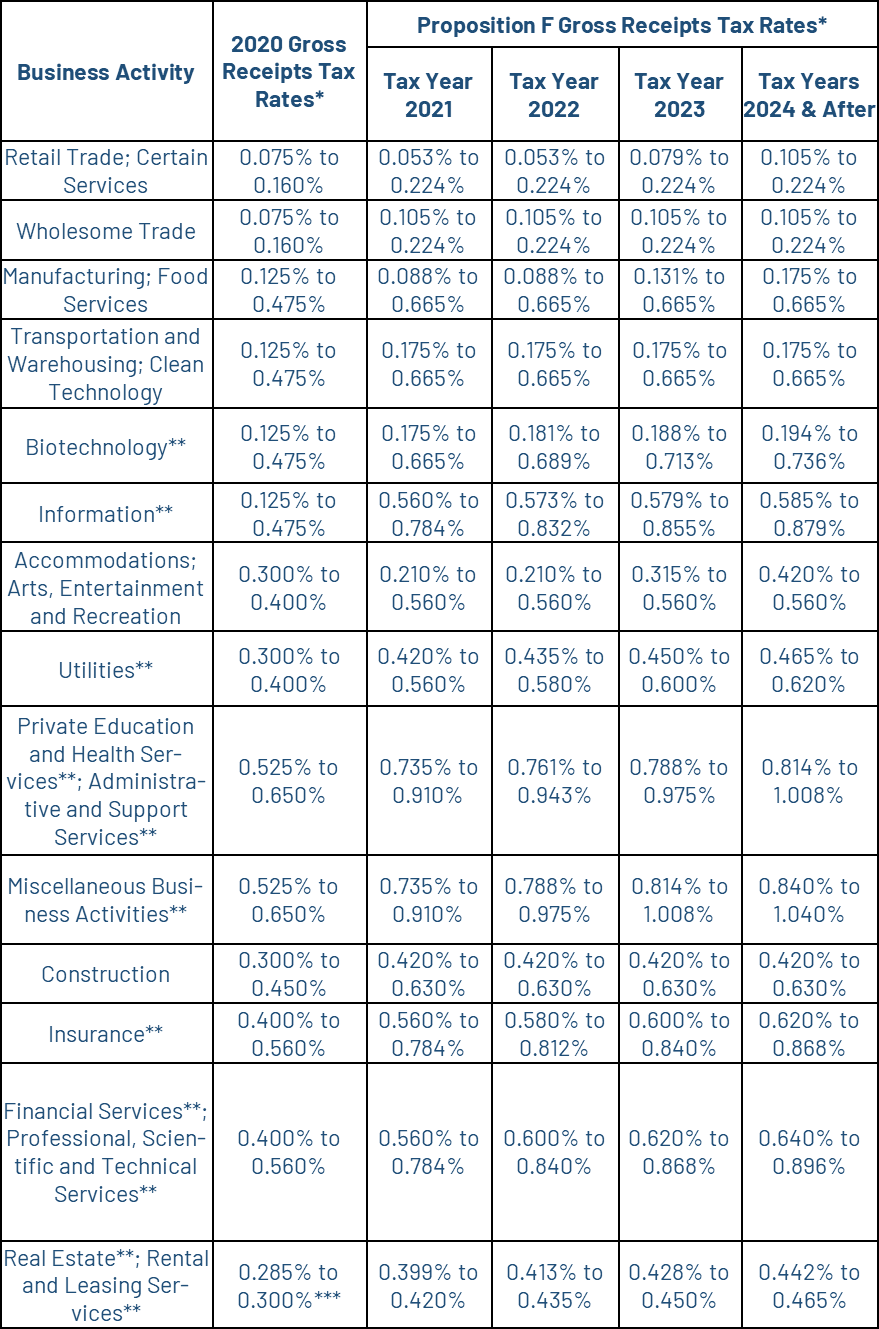

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022.

. This 153 federal tax is made up of two parts. The payroll tax became effective on October 1 1970. San Francisco Business and Tax Regulations Code Annotations Off Follow Changes Share Download Bookmark Print Editors note.

No one because there isnt one. Nomersbiz Prepare A Tax Return Services In Usa Business Tax Tax Services Online Taxes. Tax rate for nonresidents who work in San Francisco.

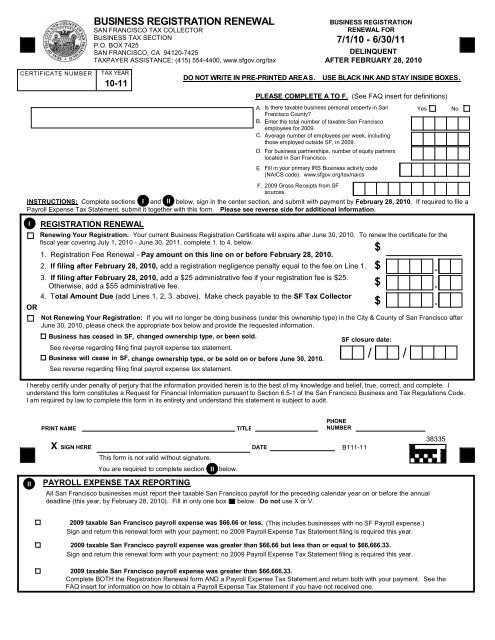

Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their payroll expense in San Francisco in lieu of the additional gross receipts tax. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Proposition F fully repeals the Payroll Expense.

All 92 counties in Indiana have an individual income tax ranging from 15 in Vermillion County to 285 in Pulaski County. There is a San Francisco gross receipts tax that took effect in 2014 that replaces the San Francisco payroll tax. Gross Receipts Tax and Payroll Expense Tax.

Social Security has a wage base limit which for 2022 is. About a decade ago a coalition of 68 companies. San Francisco used to have both a payroll tax and a gross receipts tax in place with firms paying whichever was higher.

Article 12-A the Payroll Expense Tax Ordinance was. Does San Francisco have a payroll tax. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. Proposition F completed the Citys transition from a Payroll Expense Tax to a.

C levy to support services for the. Does san francisco have a payroll tax Monday June 13 2022 Edit. Lean more on how to submit these installments online to.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. Over the years the payroll tax rate has changed from a low of 11 percent to a high of 16 percent.

Allen County levies an income tax at 148. Payroll Expense Tax. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are.

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. 124 to cover Social Security and 29 to cover Medicare. From imposing a single payroll tax to adding a gross receipts tax on.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. This is imposed on businesses. Where employees actually work is critical information in calculating a San Francisco companys gross receipts tax payroll tax and Prop.

Answer 1 of 4. Since 1995 the payroll tax rate has. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Twitter Cuts Oakland Office Space Reducing San Francisco Footprint

Scene In San Francisco Rebate Program Film Sf

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Check Out Spotify S Swanky New San Francisco Digs Digital Music News

San Francisco Isn T Dying Despite Tech Departures

Different Types Of Payroll Deductions Gusto

Ed Lee S Plan To Overhaul S F Business Payroll Tax

Technology Can Help Prevent Tax Withholding Miscues Tied To Remote Work

San Francisco Gross Receipts Tax Clarification

Maria Jocelyn Co Owner At Nomersbiz Accounting Payroll Tax Services San Francisco California United States Linkedin

Payroll Tax Vs Income Tax What S The Difference

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Gross Receipts Tax Gr Treasurer Tax Collector

San Francisco Tech Tax Would Help Homelessness

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

2009 Lg Payroll Tax Statement And 2010 2011 Registration Form