what is a fit deduction on paycheck

FIT deductions are typically one of the largest deductions on an earnings. FIT Fed Income Tax SIT State Income Tax.

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Job Description Template Checklist Template Resume Template

FITW stands for federal income tax withholding Its the amount your employer deducts from your earnings each pay period and remits to the IRS on your behalf.

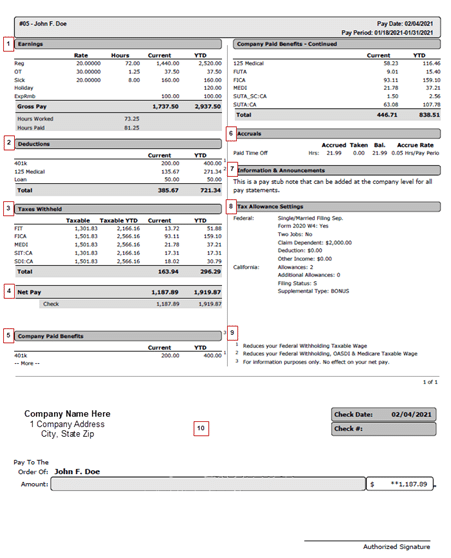

. Gross pay is the total amount of pay before any deductions or withholding. Both Social Security and Medicare taxes are fixed-rate taxes you withhold from your employees wages and pay on behalf of your employees. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. While the task of figuring out FIT withholdings for your employees may. If you see the fit deduction listed on your paychecks earning statement it is an acronym for federal income tax.

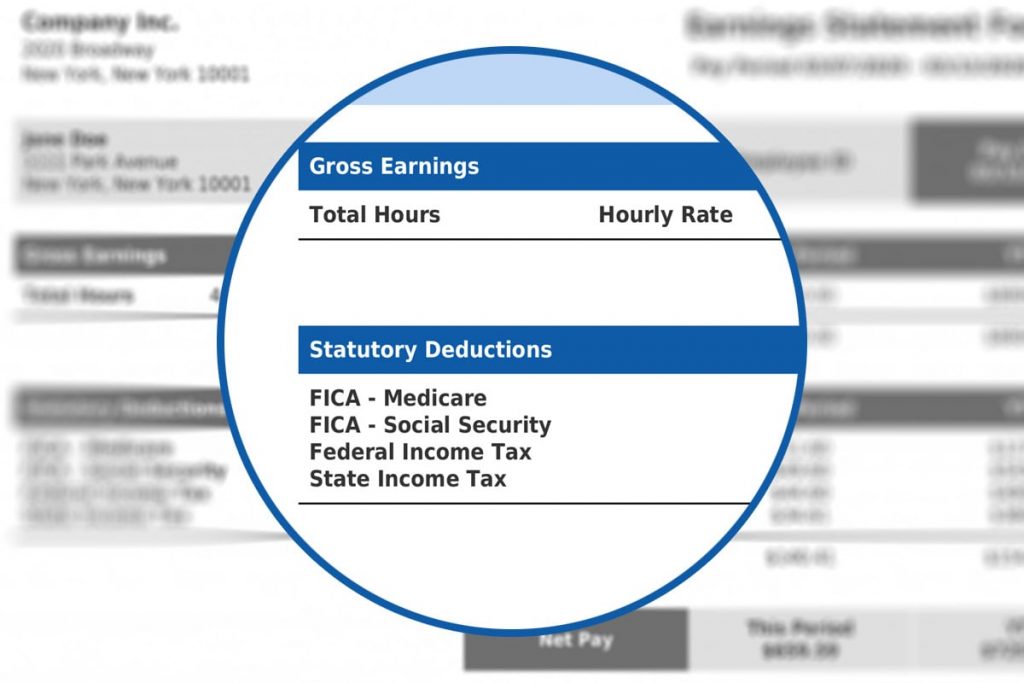

Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. To calculate federal income tax withholding you will need.

Some are income tax withholding. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. Federal Income Tax FIT and Federal Insurance Contributions Act FICA.

Net pay Net pay is the amount you take home after. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Fit deductions are typically one of the largest deductions on an earnings.

The Federal Income Tax is progressive so the amount will vary based on the. These items go on your income tax return as. Employers withhold or deduct some of their employees pay in order to.

The FIT deduction on your paycheck represents the federal tax withholding from your gross income. What is the fit tax rate for 2020. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages.

An individuals paycheck for state income taxes. Federal payroll tax responsibilities include withholding and payment obligations for federal income tax or FIT. FIT deductions are typically one of the largest deductions on an.

They are all different taxes withheld. All but seven states AK FL NV SD TX WA and WY have state income taxes. These taxes fall into two groups.

Federal taxes are the taxes withheld from employee paychecks. The federal income tax rates remain. Federal income tax is withheld from an employees earnings such.

If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax. In California the State Disability Insurance SDI could be used as a Schedule A. For the purpose of determining income tax and FICA tax for Social Security and Medicare use.

Fit represents the deduction from your gross salary to pay federal withholding also known as income taxes.

Pre Tax Vs Post Tax Deductions What Employers Should Know

Explore Our Sample Of Employee Pay Increase Template For Free Salary Increase Templates Wine Label Template

Different Types Of Payroll Deductions Gusto

What Are Pay Stub Deduction Codes Form Pros

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Deduction Authorization Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates Printable Free

Can Fit Deductions Be Rounded Up In Qbo Payroll

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Wonderfull Home Office Deduction Designing Offices Small Space Office Desk Home Office Designs For Small Spaces Offices Ideas Irs Forms Tax Forms Tax Refund

What Are Pay Stub Deduction Codes Form Pros

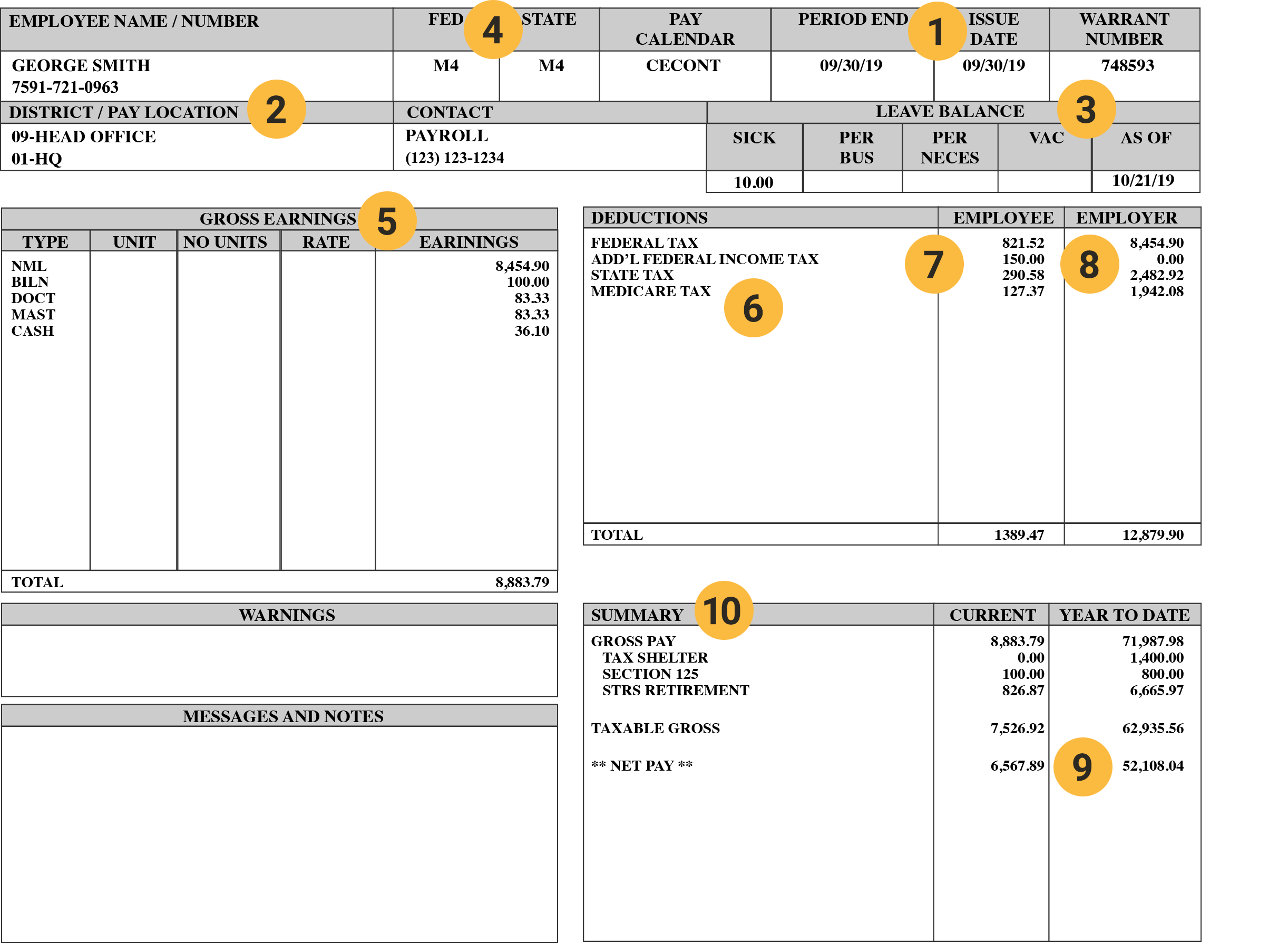

Understanding Your Pay Statement Innovative Business Solutions

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Pre Tax Vs Post Tax Deductions What Employers Should Know

Understanding Your Paycheck Credit Com